Payroll Module

This document covers only the Payroll Module. For other modules please refer to Onekhata Modules

Table of Contents :

Definations :

-

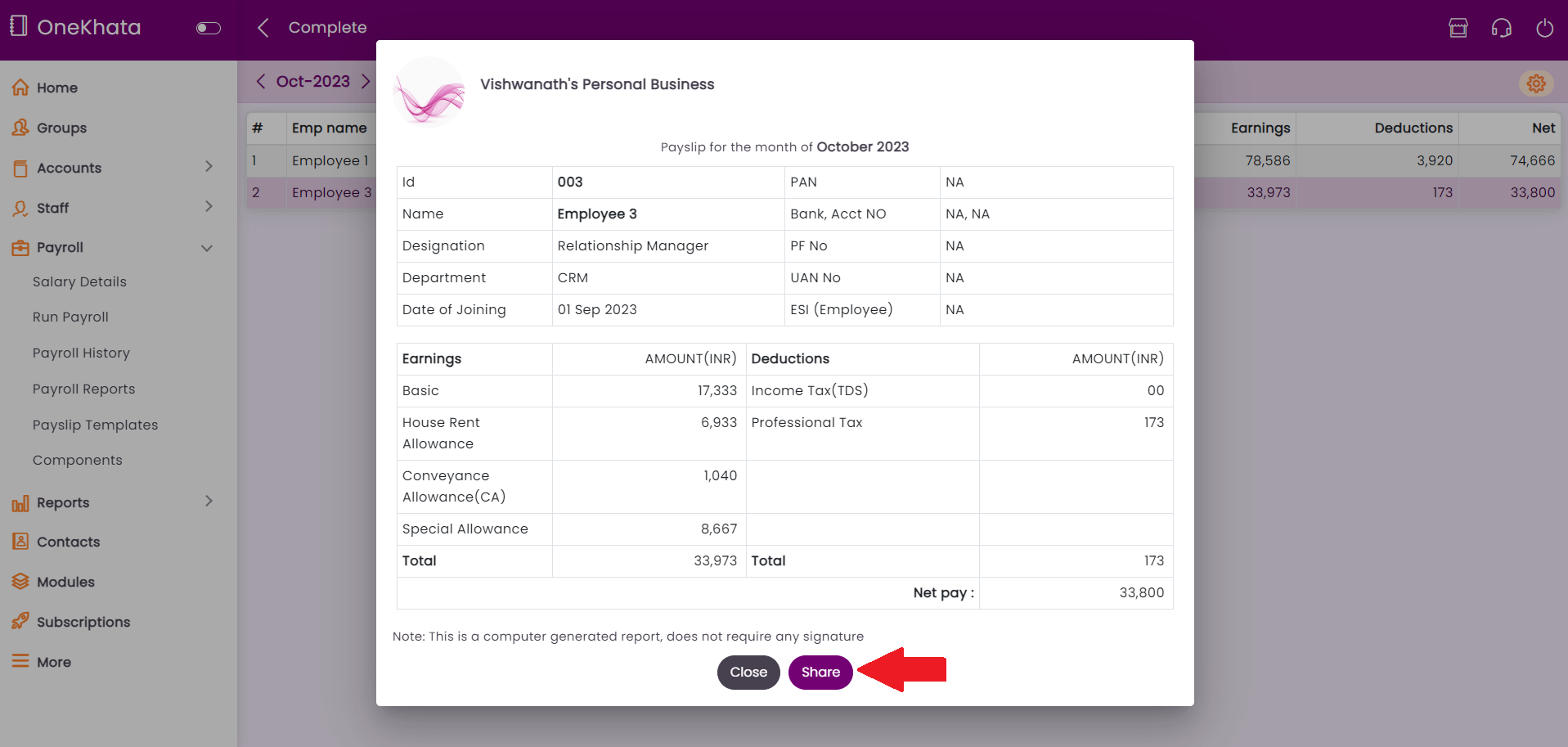

Salary / Payslips

It is a document that every organization is liable to provide to its employees every month. The slip includes information regarding the employee’s basic salary, allowances, deductions & net payable amount for a given month. It works as proof of salary payment and is generally provided by the organization to its employees either as a soft copy or hard-copy.

-

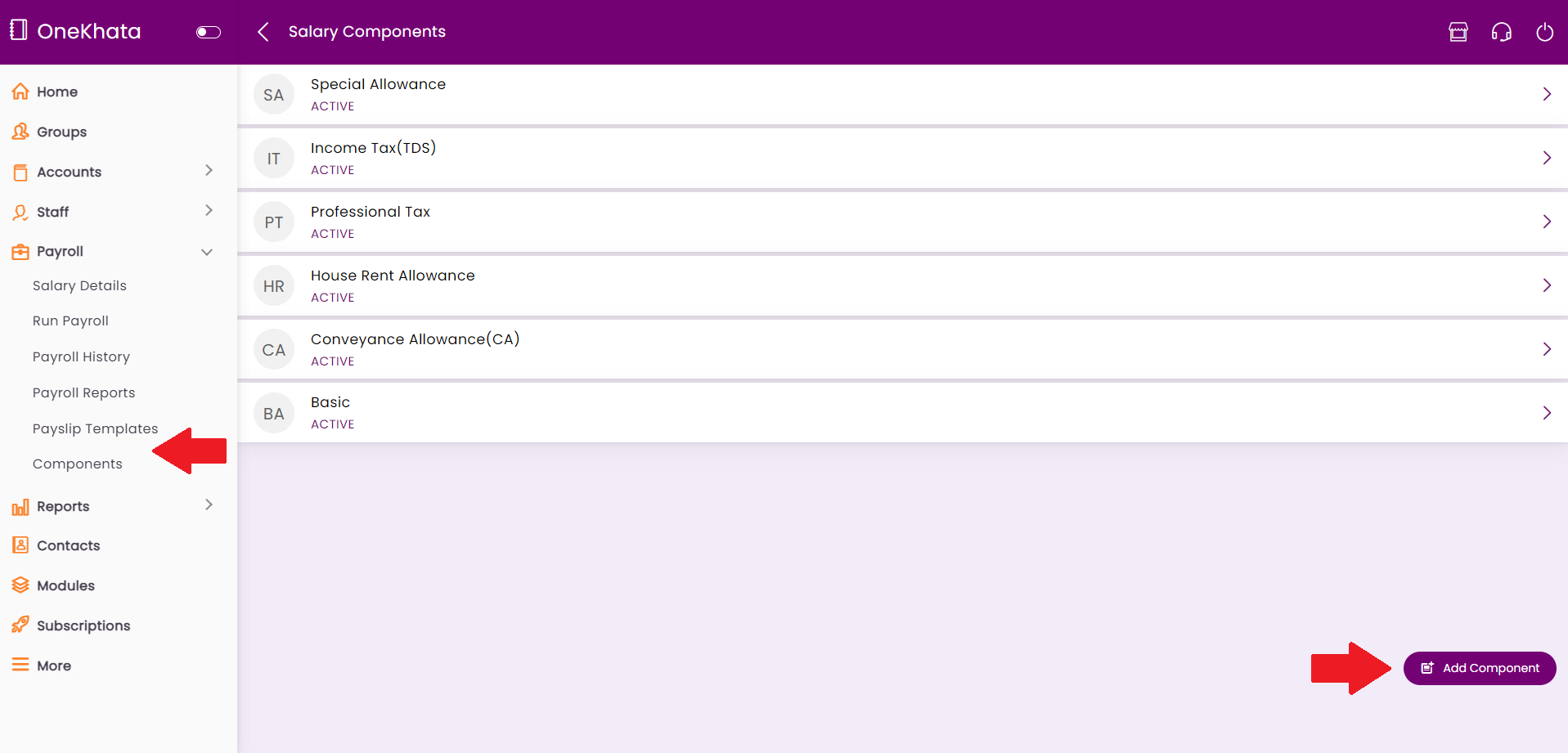

Components

Salary / Pay-slip gives a clear picture of Basic salary, Allowances, Incentives, Deductions and net payable-amount, each of these is a Salary / Pay-slip component.

-

Templates

Each organization may have one or more salary templates based on their needs. For example: Some top management employees / field employees may have very specific components which may not be necessary for other employees. With templates you can customize the way pay-slip looks for the respective employees.

-

Earnings

Anything payable to the employee is considered as an Earning. Like Basic Salary, HRA, Incentive etc.,

-

Deductions

Anything to deduct as per applicable laws / rules from an Employee's salary before making a salary payment is a Deduction. Like Professional Tax, TDS / Income Tax, Repayment towards Salary Advance etc.,

-

Statutory

Any salary component that is divided by the Law. Like Professional Tax, TDS / Income Tax, ESI etc.,

-

Payroll / Process Salary

In general, this is a monthly practice. Payroll processing involves calculation of attendance / payable days or hours, salary adjustments if any, calculation of net payments, salary payments, file tax reports like Professional Tax, Income Tax if applicable, Document and store records.

-

Attendance & Salary Dependency

Some of the salary components are attendance dependent and while some others may not. While creating pay-slip components please select an appropriate option as applicable. Please talk to a Relationship Manager for any support you may need.

Details :

-

Setup

- Enable Payroll Module

- Manage Staff

- Salary Configuration

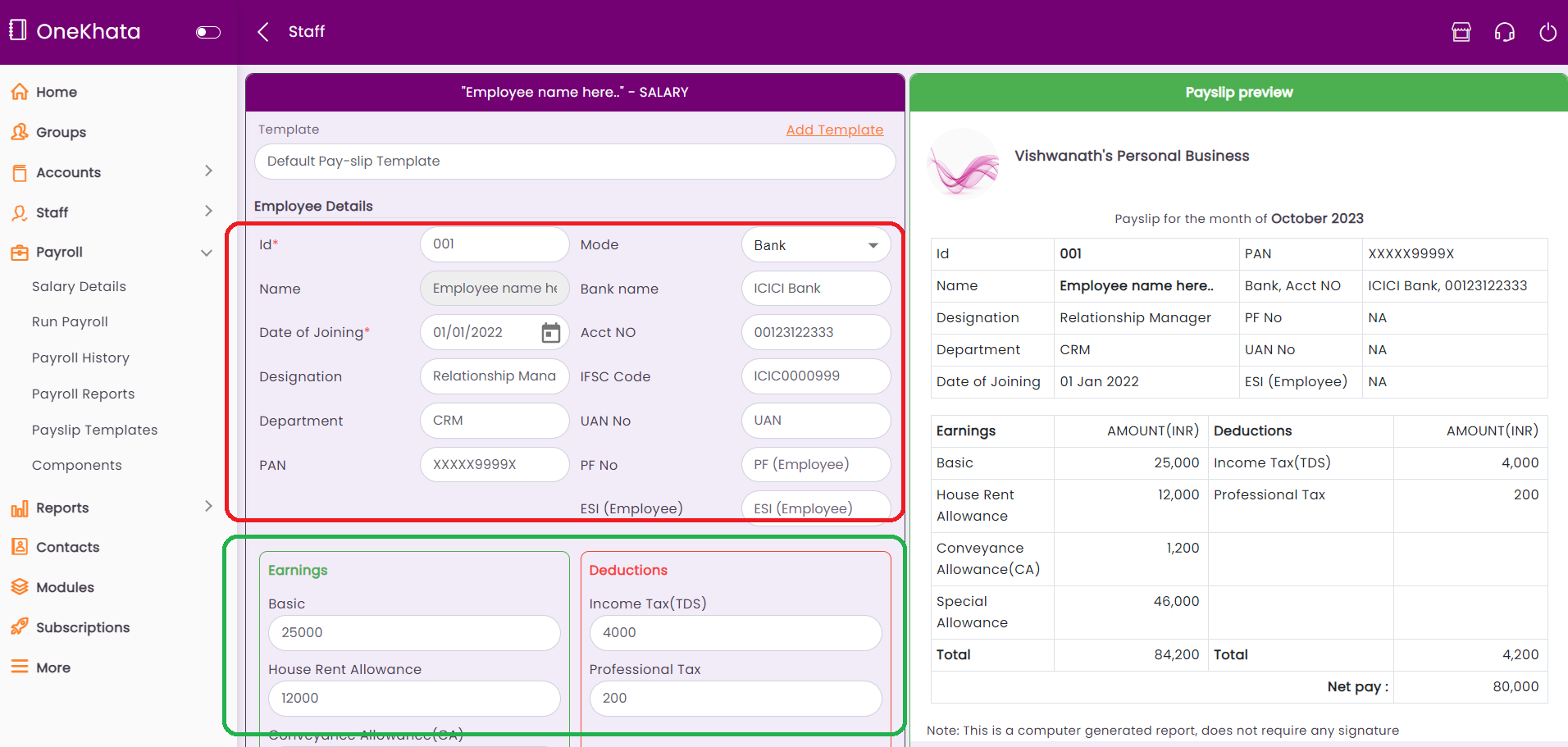

- Employee information like ID, Date of Joining

- Salary details like Basic, HRA etc.,

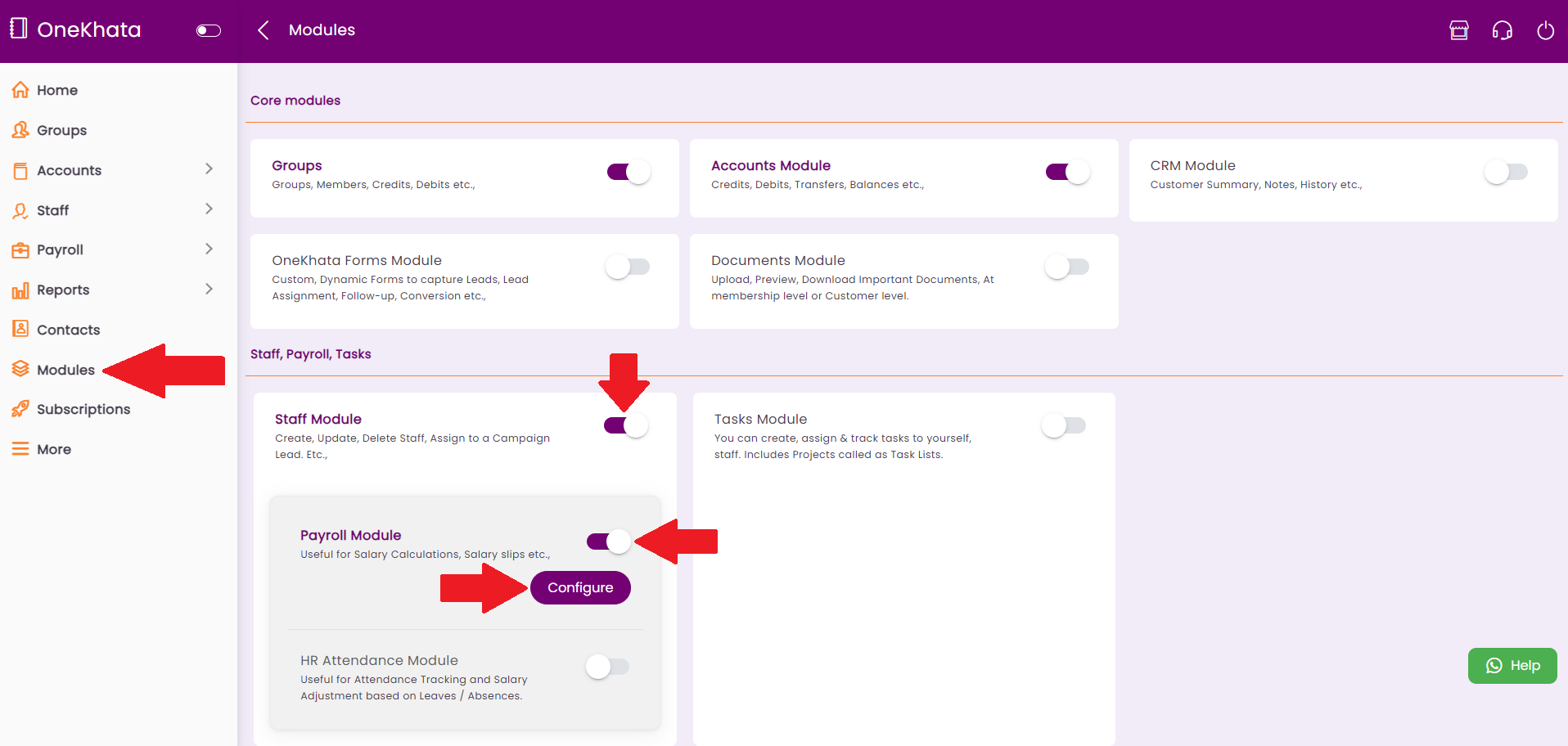

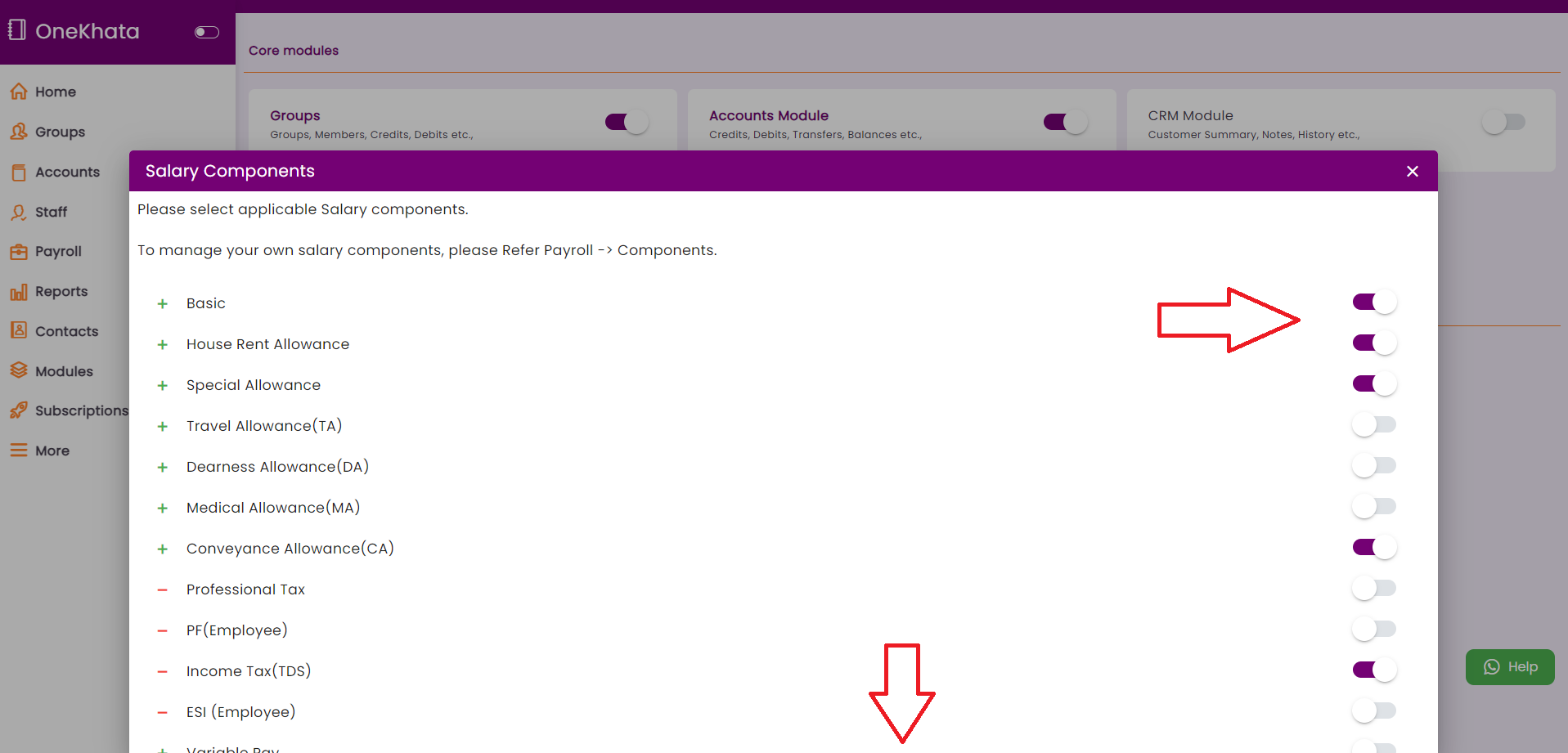

Modules -> Enable Staff Module, Enable Payroll Module. Click Configure.

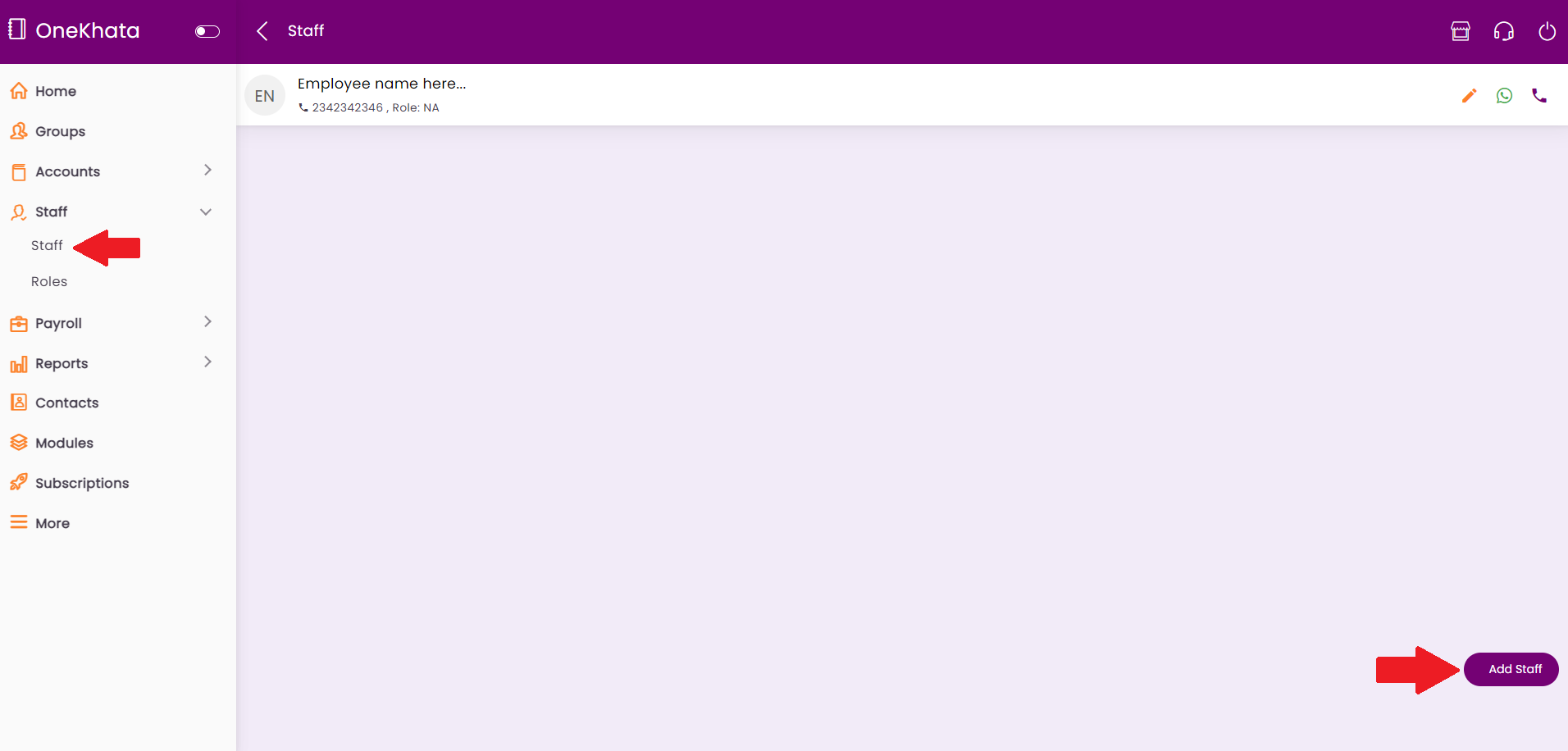

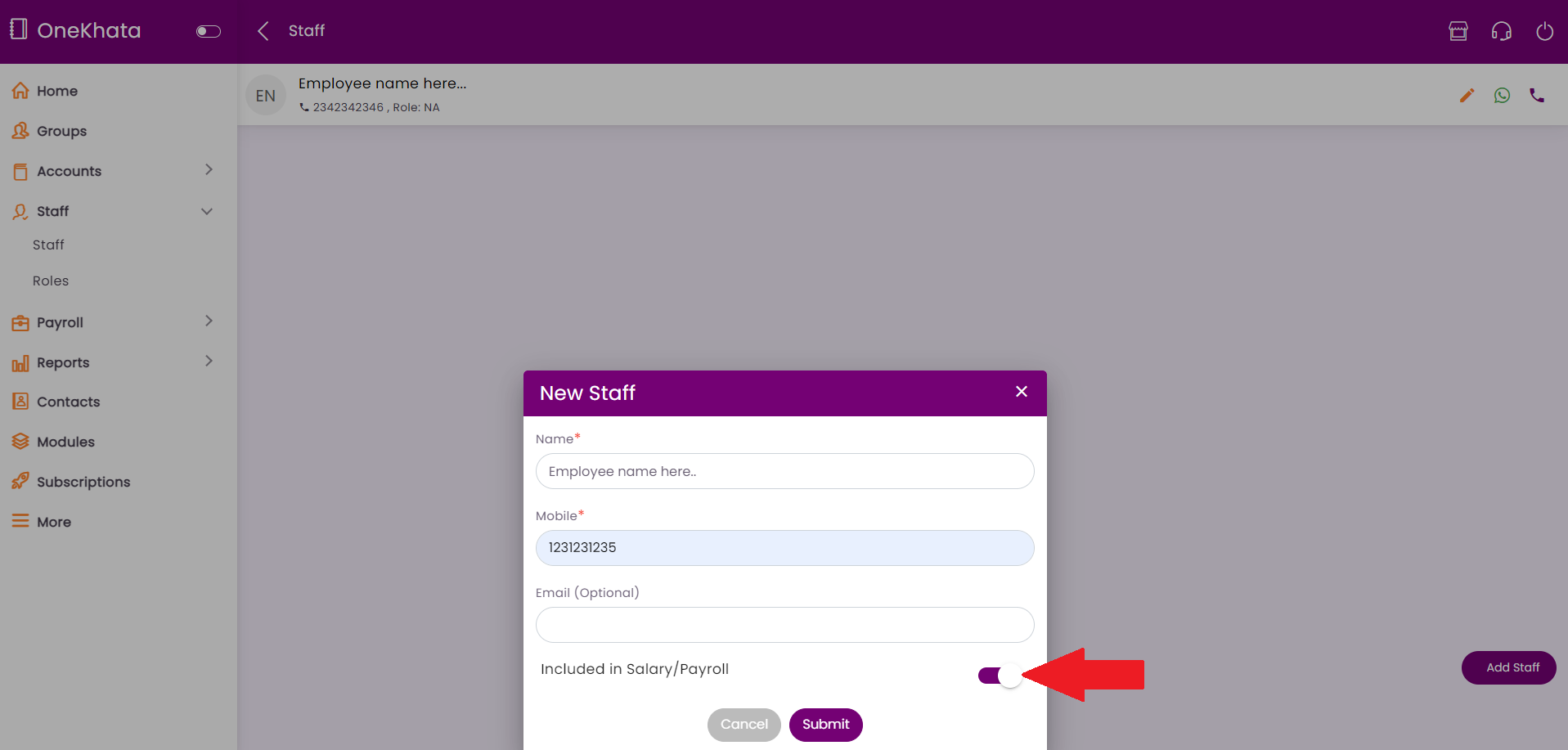

Staff -> Add Staff -> Enter Name, Mobile etc., Select Included in Payroll.

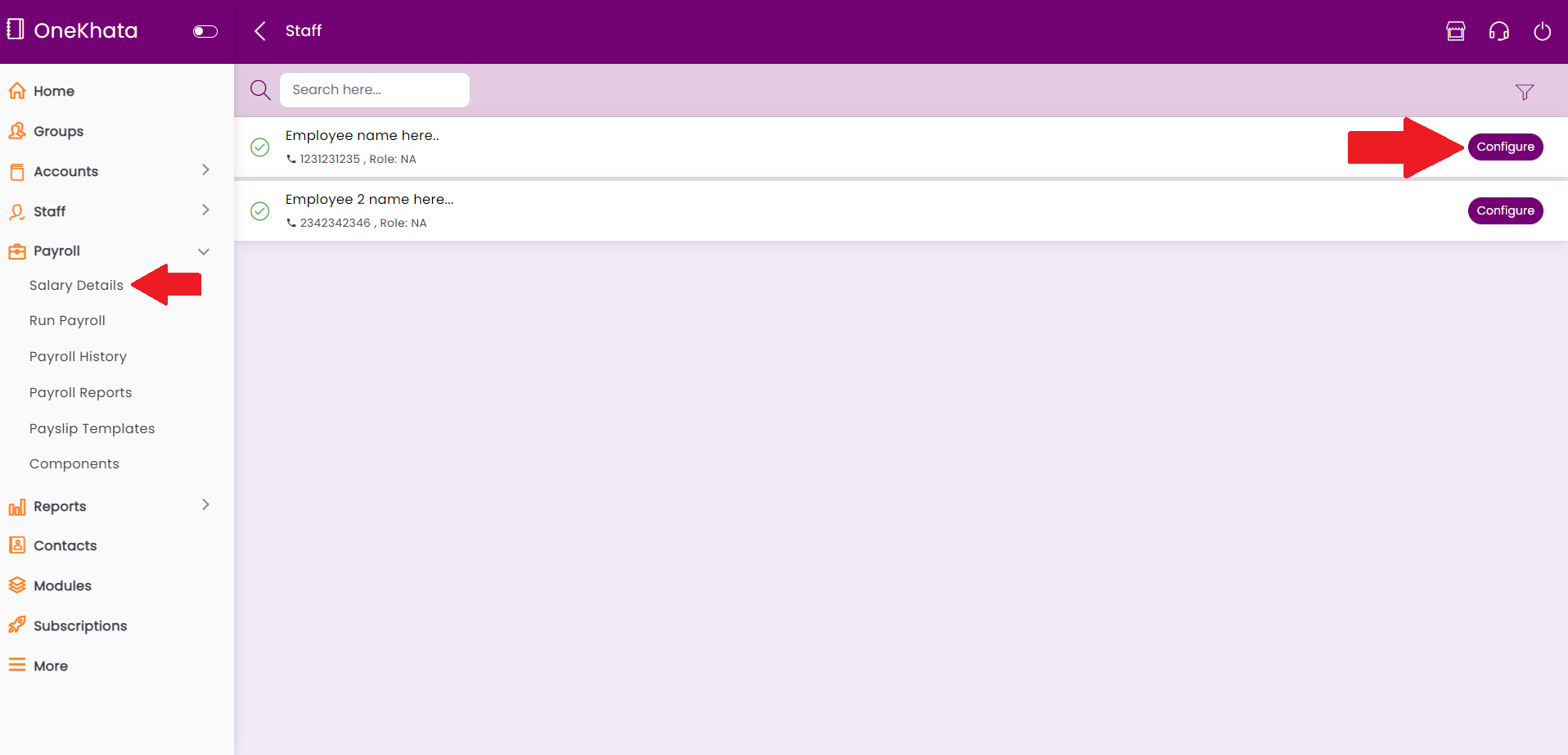

Payroll -> Salary Details -> Configure at each employee level.

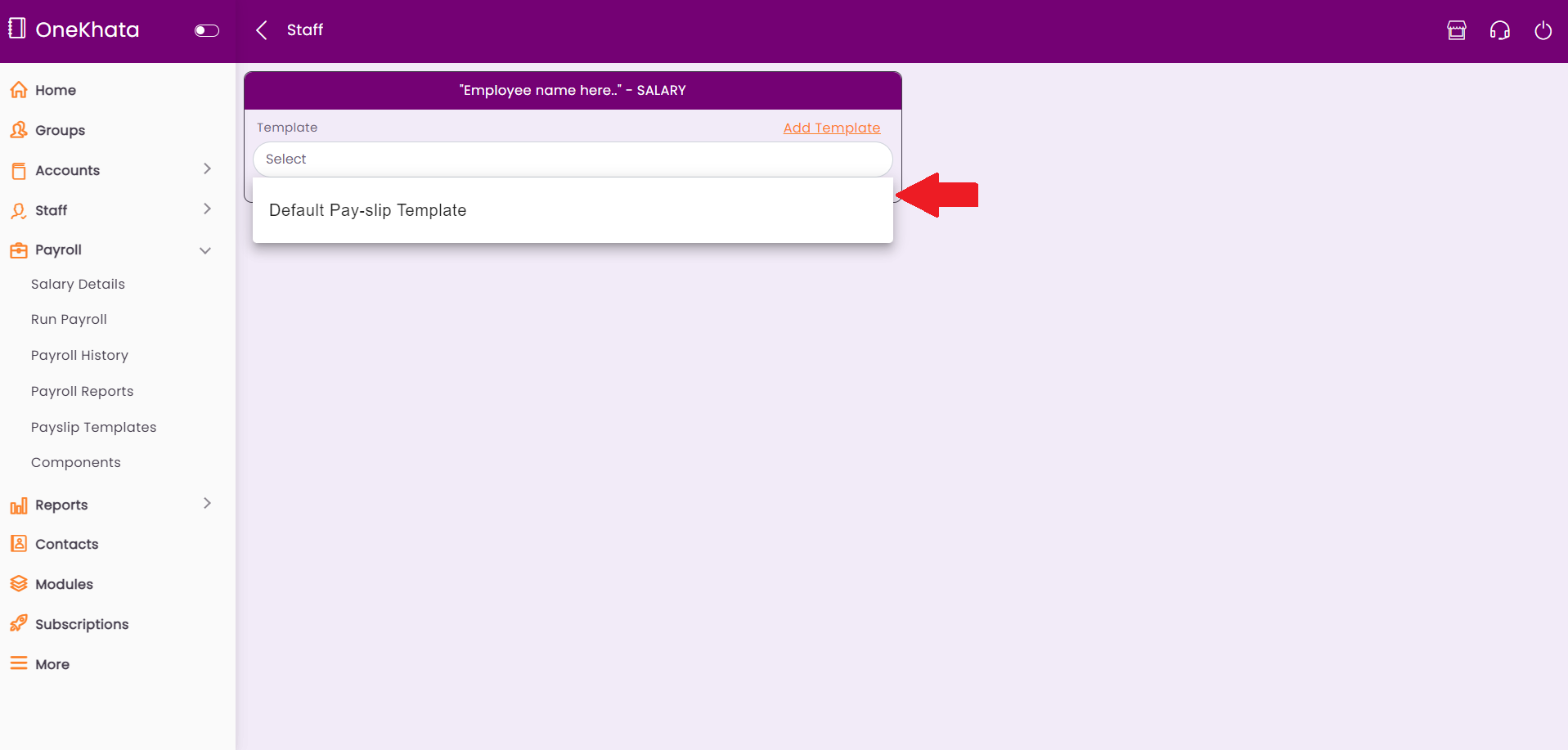

Select an existing template. You can also add your own templates, if required.

Enter the following information

-

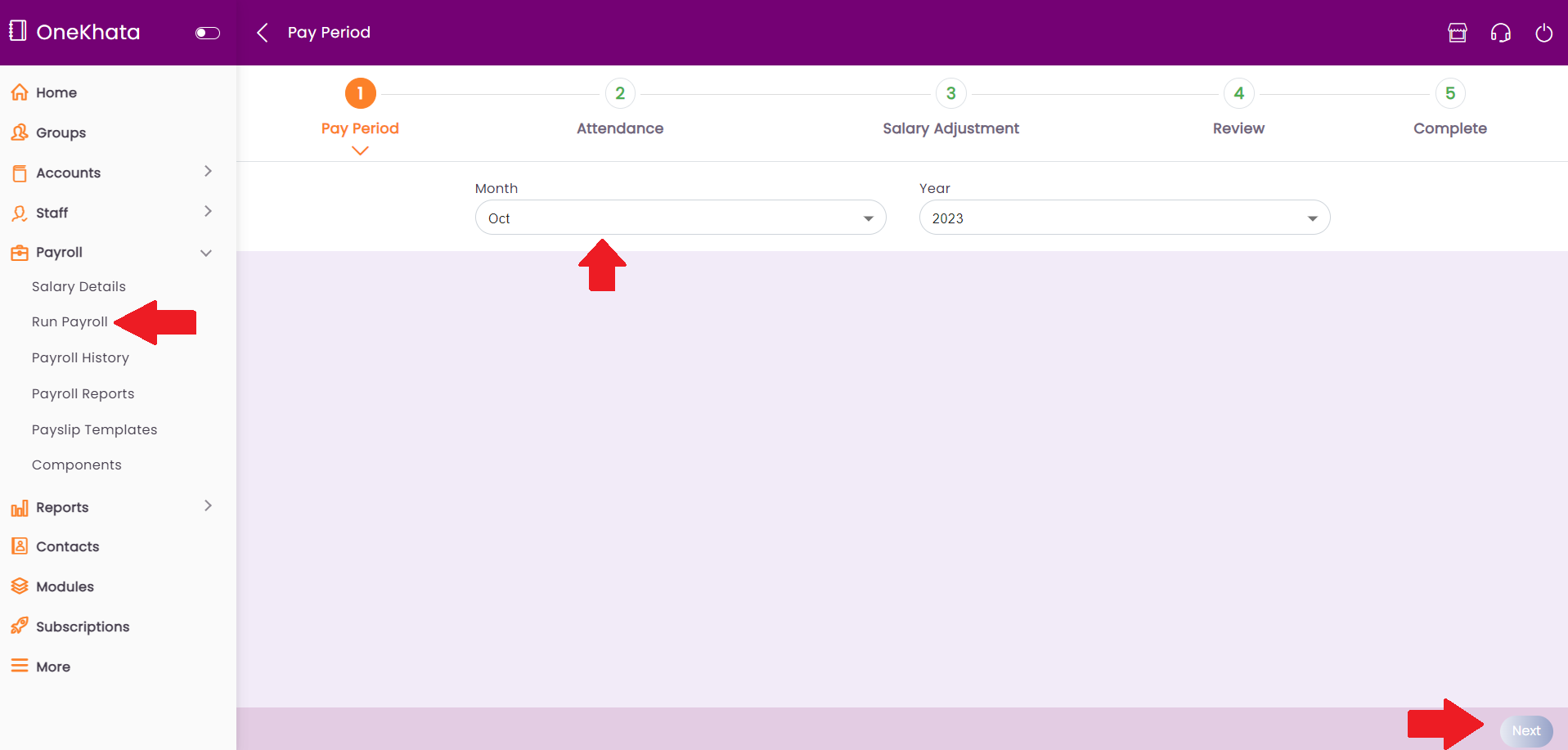

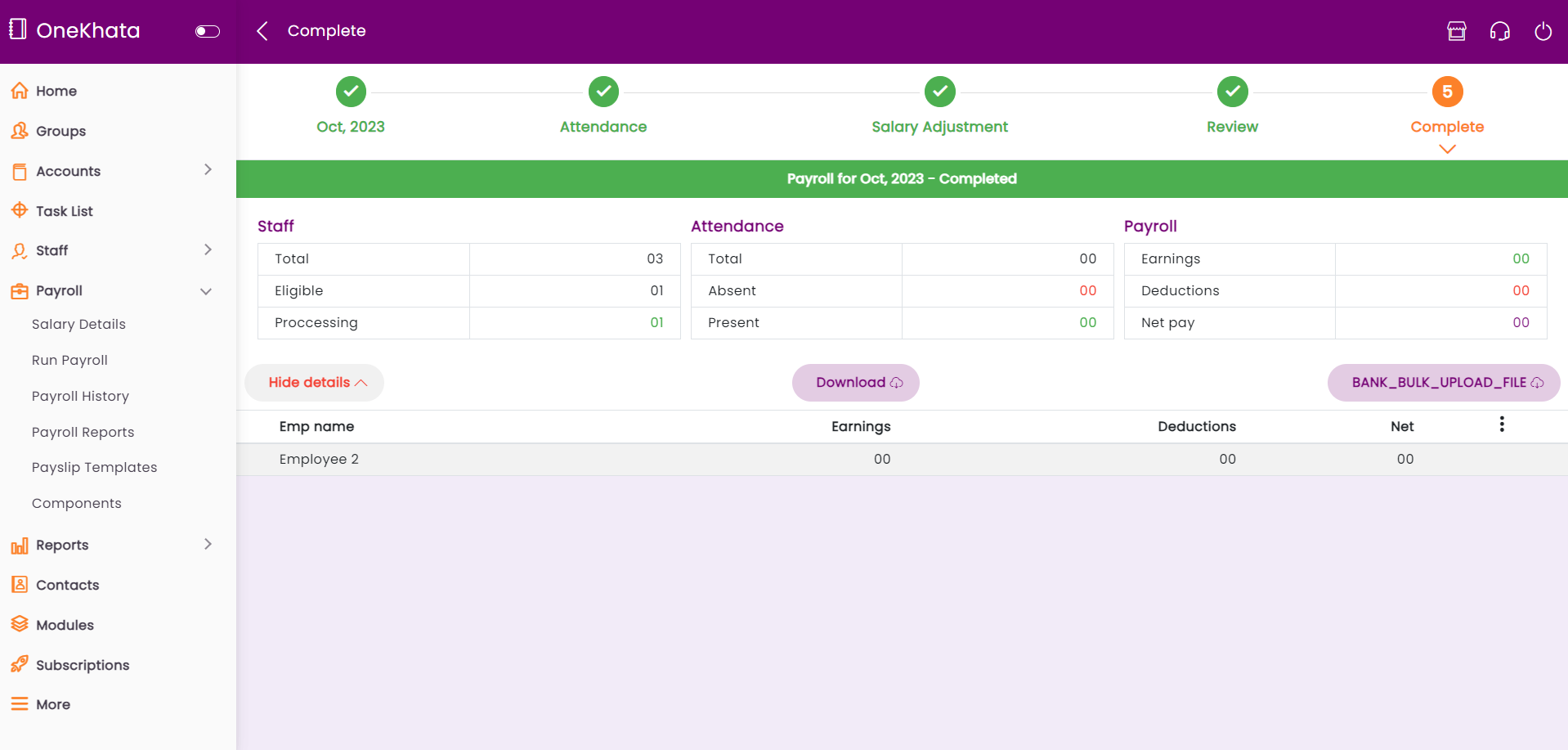

Run Payroll

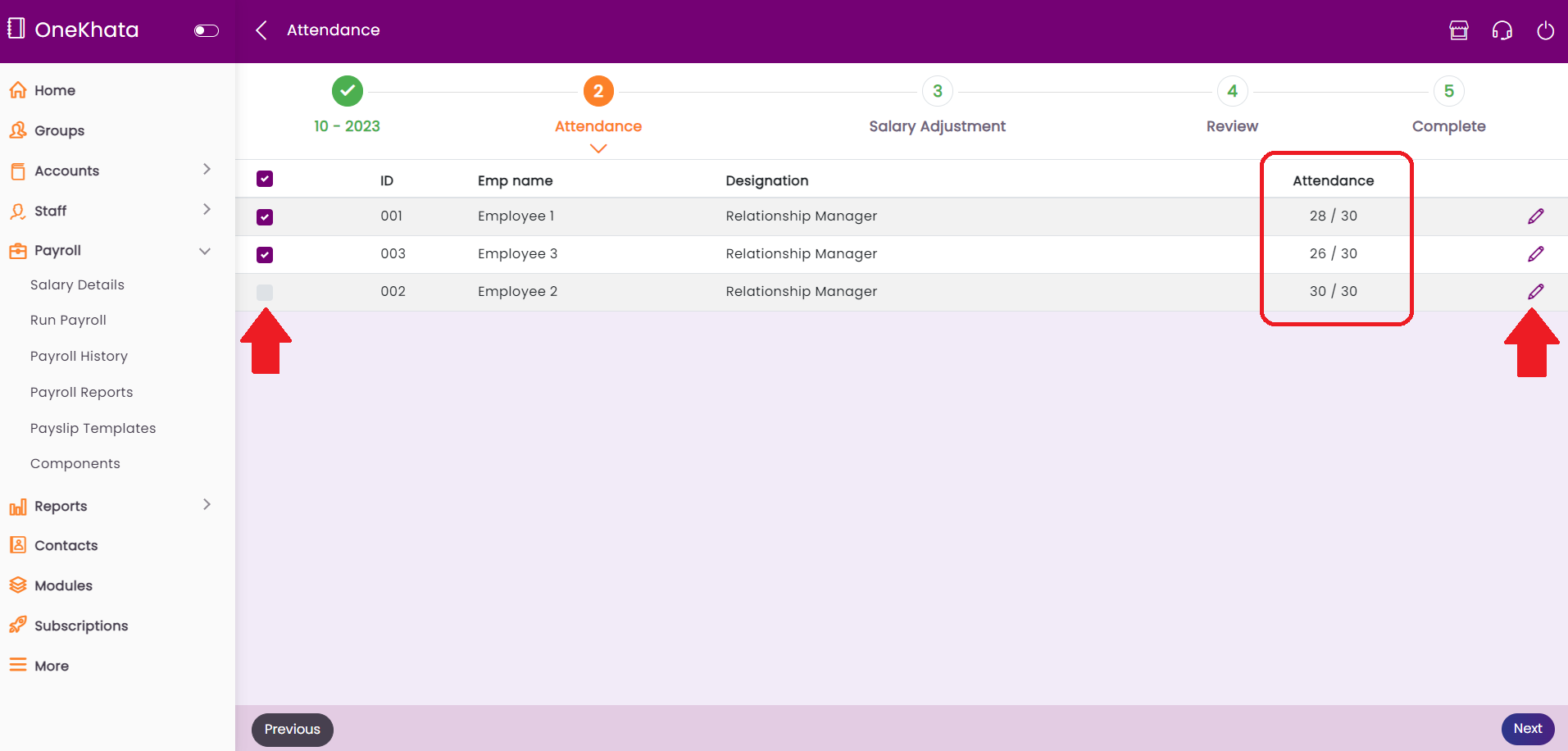

- Select a Time Period: Month, Year.

- Select Employees

- Adjust Attendances - If any.

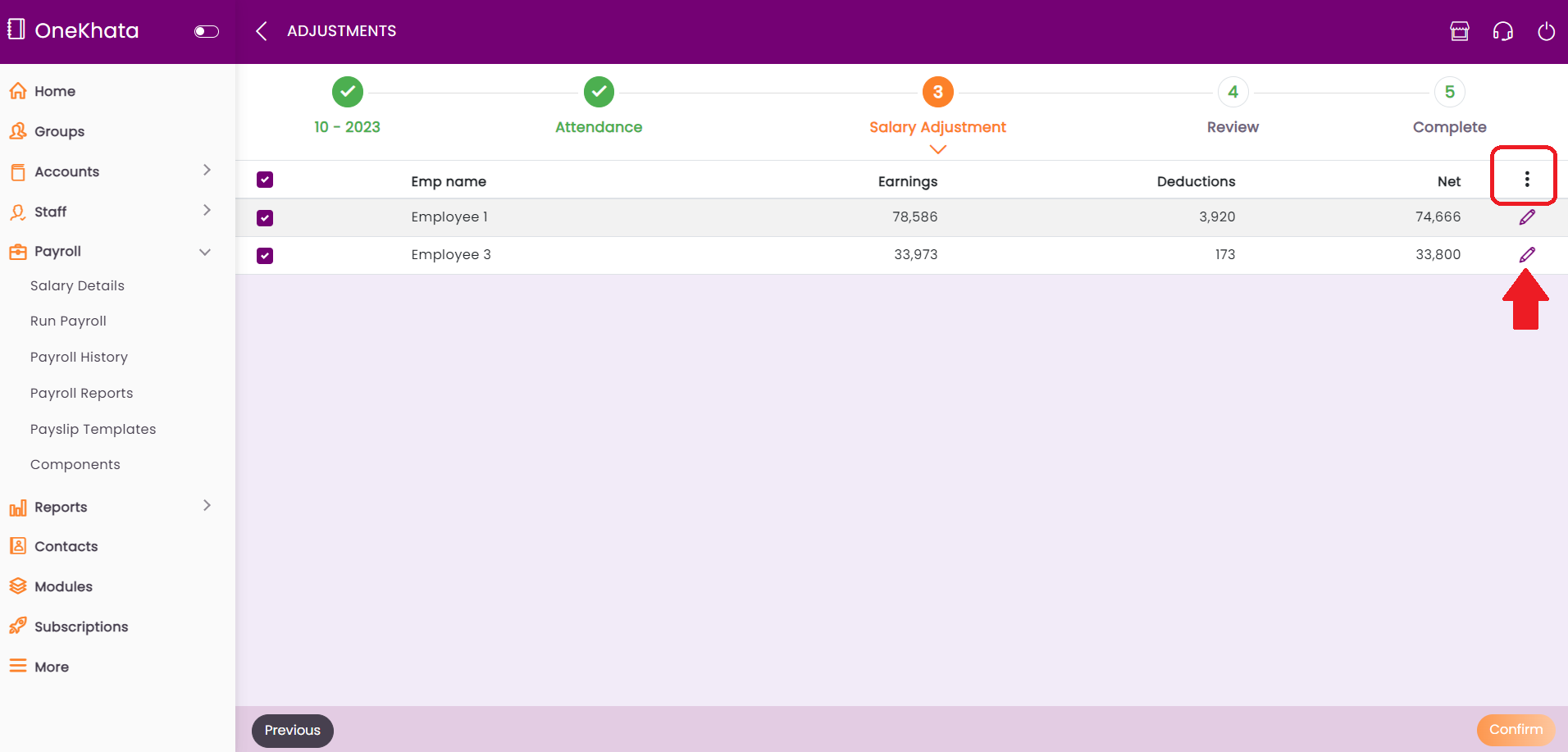

- Adjust Salaries - If any.

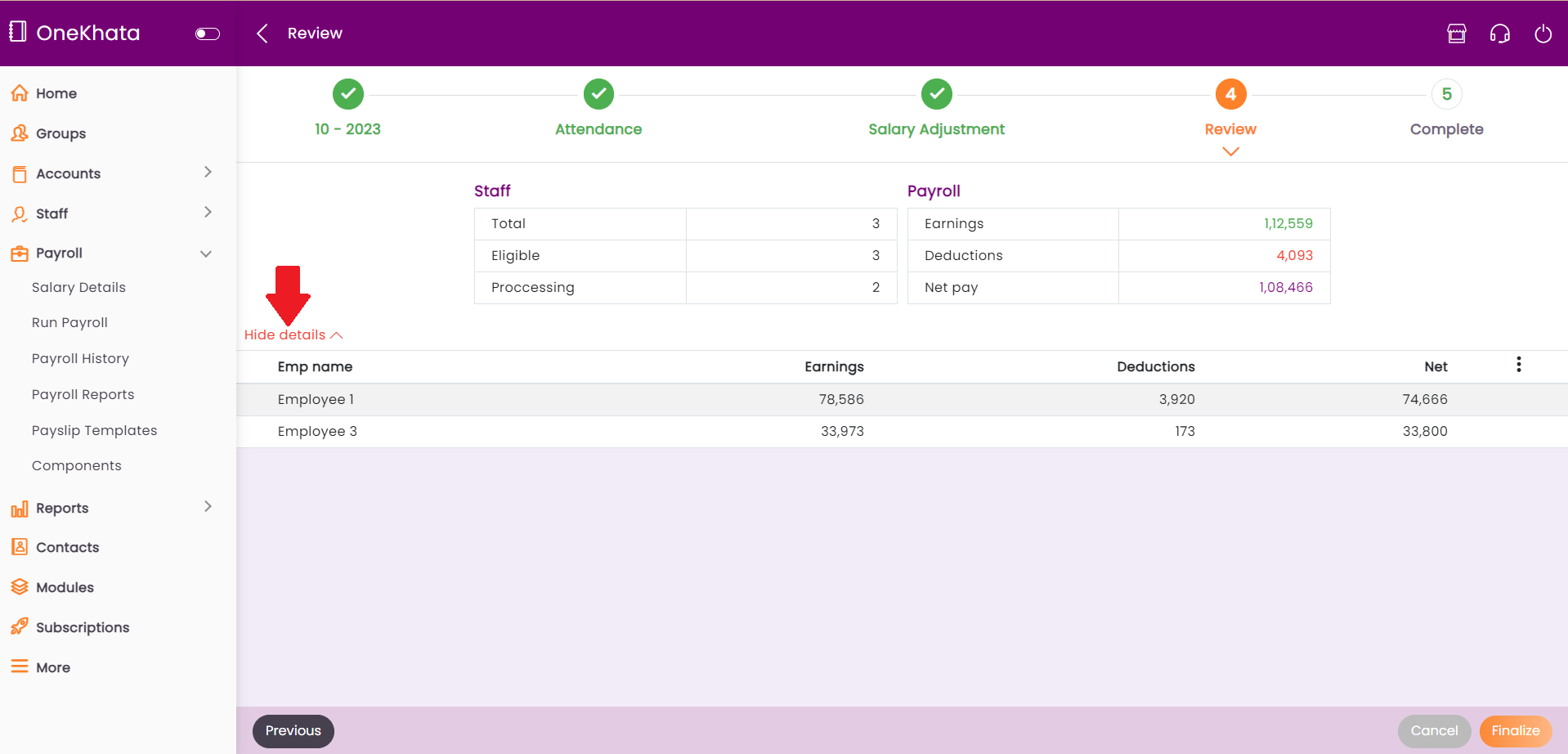

- Review

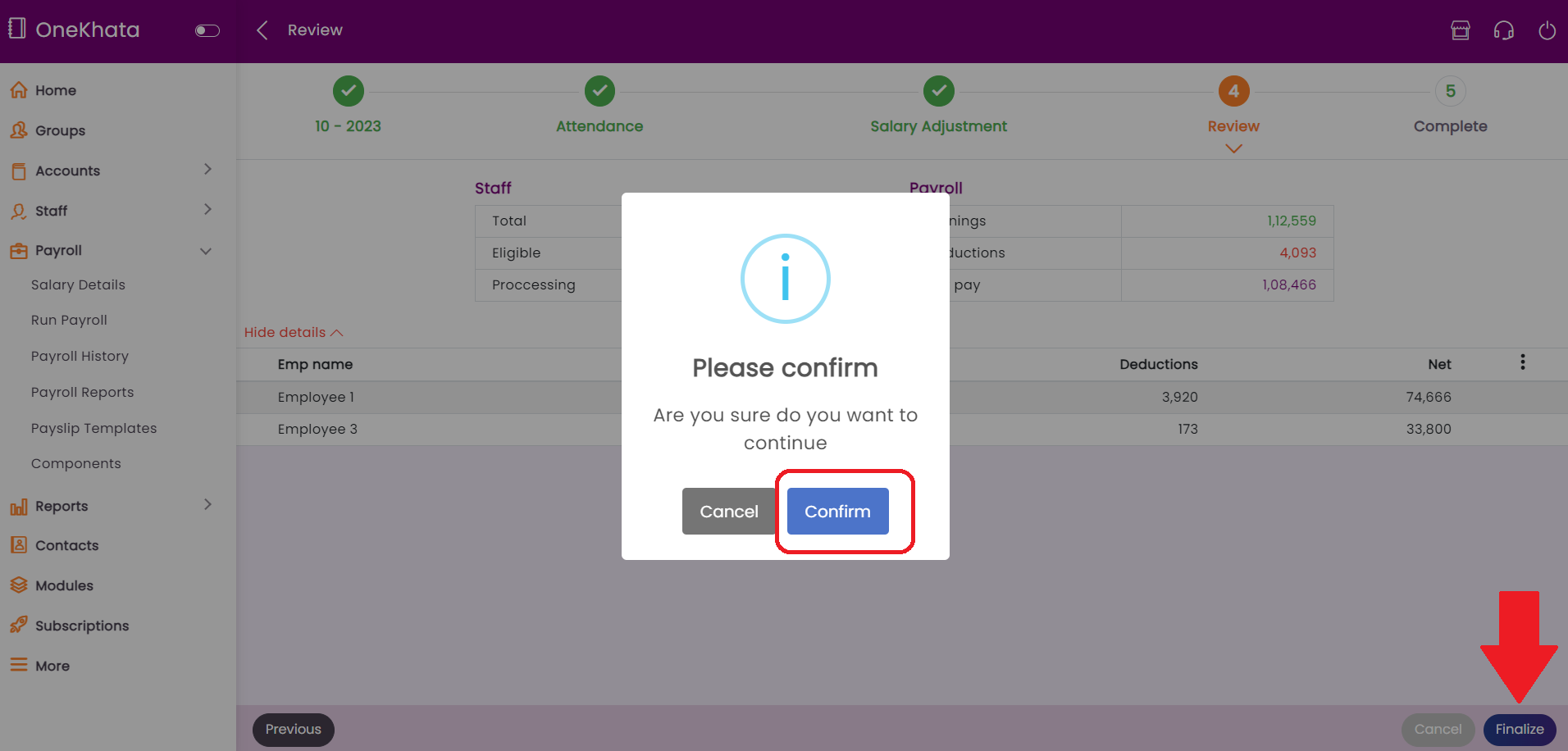

- Finalize

See Payroll History below

-

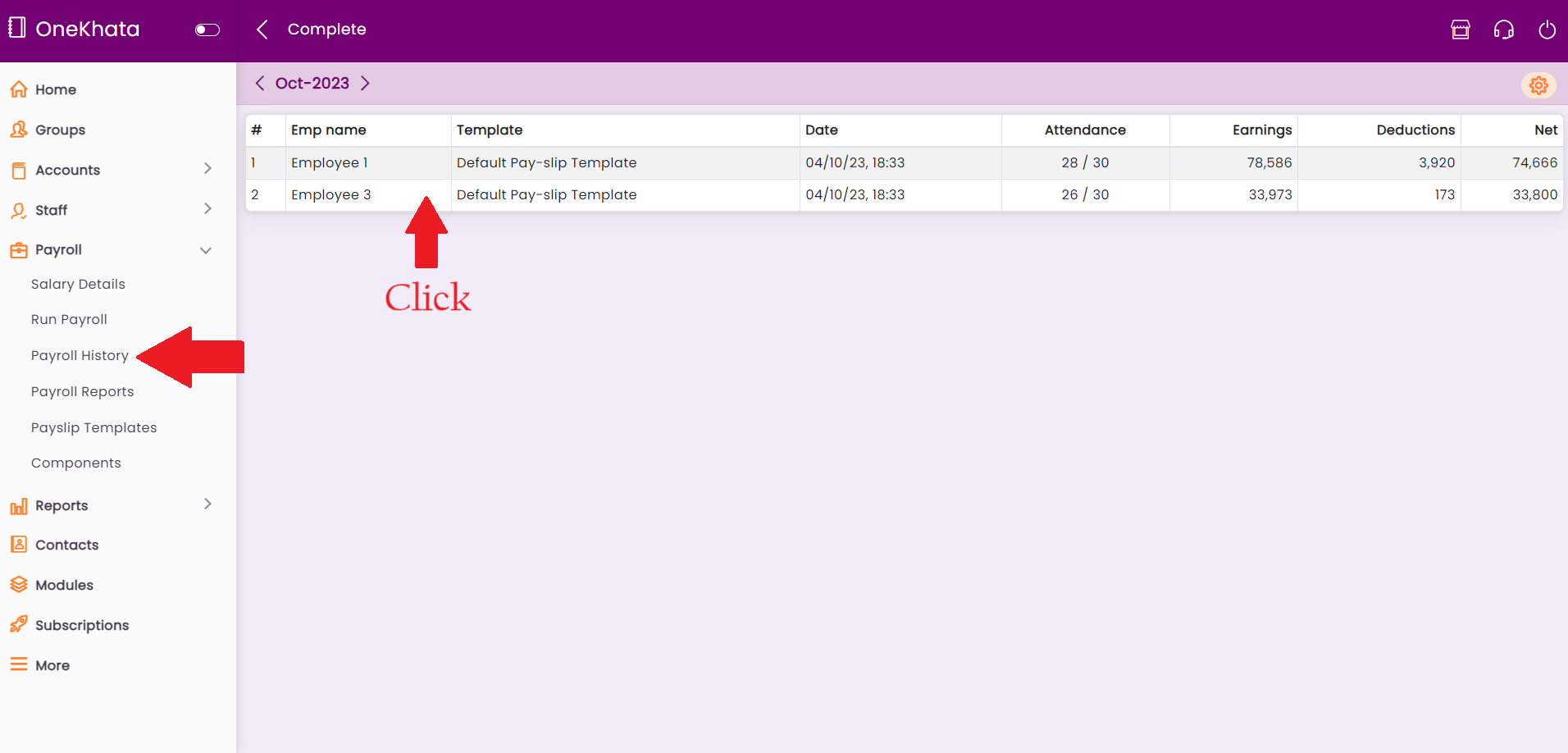

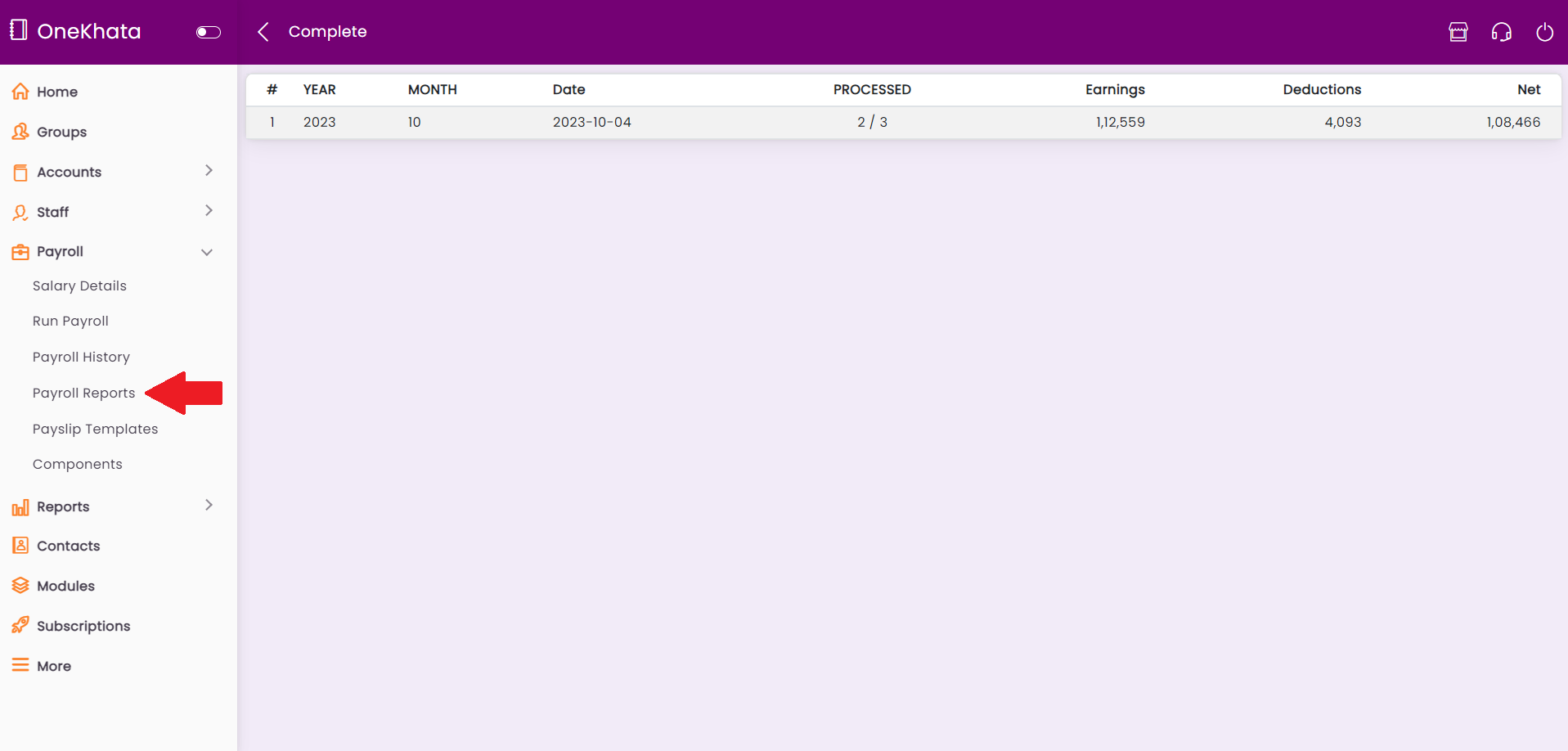

Reports & History

- Payroll History

- Payroll Reports

-

Customize

- Manage Salary Components

- Manage Salary Templates

Additional Resources :

- From time to time, additional resources shall be added here.